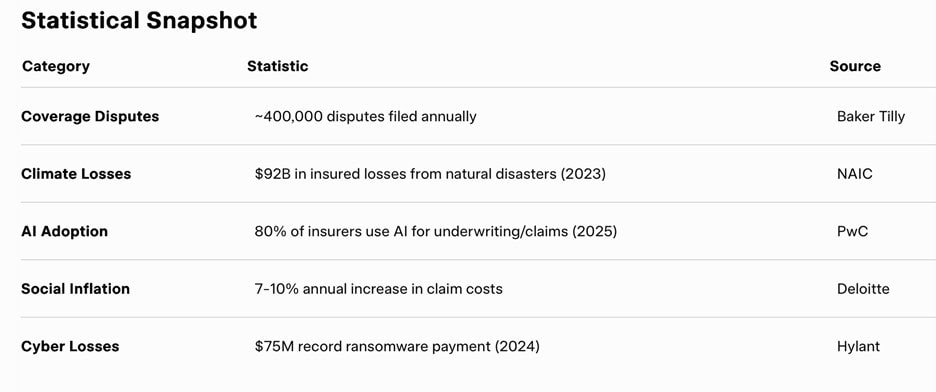

With thousands of ongoing insurance coverage disputes in U.S. courts, the legal landscape governing insurance policies is under intense pressure in 2025. From catastrophic climate-driven claims to controversies over artificial intelligence (AI) in underwriting, escalating social inflation, the rapid evolution of cyber insurance, and stringent regulatory reforms, insurance coverage law is at a pivotal moment. These trends are reshaping how insurers, policyholders, and corporate defendants navigate their rights and obligations, creating both challenges and opportunities. For all stakeholders, understanding these shifts is critical to securing fair outcomes and maintaining stability in a volatile market. This article dives into five transformative trends in insurance coverage law, offering actionable insights to thrive in this dynamic environment.

- Climate-Driven Claims: Expanding Insurer Obligations

Trend Overview

Climate change is redefining insurance coverage disputes, as hurricanes, wildfires, and floods trigger billions in claims. In 2023, natural disasters caused $92 billion in insured losses, a trend intensifying into 2025. Courts are increasingly interpreting “all-risk” policies to cover climate-related damages, challenging traditional exclusions.

Legal Implications

- Policy Exclusions: Disputes focus on whether climate losses fall under “natural causes” exclusions, with courts often favoring policyholders.

- Business Interruption: Claims for climate-related business disruptions are rising, testing policy limits.

- Subrogation Opportunities: Insurers are pursuing recovery against polluters or governments, increasing litigation.

Adverse coverage rulings relating to alleged climate losses increase liability for insurers, necessitating clearer policy exclusion language that comports with current law.

- Artificial Intelligence: Litigation Over Bias and Transparency

Trend Overview

AI is transforming underwriting and claims processing, with approximately 80% of insurers using AI tools in 2025. However, AI-driven decisions, like claim denials, are sparking lawsuits alleging bias or lack of transparency. A 2023 class-action against UnitedHealthcare for allegedly using AI to deny Medicare Advantage claims highlights these risks. Nearly half of U.S. states have adopted NAIC (National Association of Insurance Commissioners) AI guidance, signaling increased regulatory scrutiny.

Legal Implications

- Bias Claims: Policyholders challenge AI for discriminatory pricing or denials, violating state insurance codes.

- Transparency Demands: Courts require insurers to disclose AI decision-making processes, balancing proprietary interests.

Based on these trends, insurers should strongly consider aligning AI use with evolving state and NAIC guidelines to avoid penalties.

- Social Inflation: Skyrocketing Litigation Costs

Trend Overview

Social inflation refers to the rising costs of insurance claims resulting from societal and legal trends, rather than traditional economic inflation (like higher medical costs or repair prices). Driven by large jury verdicts and plaintiff-friendly litigation, social inflation is presently inflating claim costs by an estimated 7-10% annually, particularly in commercial lines like directors’ and officers’ liability. According to Swiss Re, between 2014 and 2024, social inflation increased liability claims in the U.S. by 57%. “Nuclear verdicts” exceeding $10 million are increasingly common, fueled by public distrust of corporations and aggressive plaintiff strategies. This trend pressures insurers to bolster reserves and refine policy exclusions.

Legal Implications

- Reserve Challenges: Insurers face financial strain from underestimating claim costs.

- Exclusion Ambiguity: Vague policy language leads to litigation, often resolved in policyholders’ favor.

To overcome social inflation, insurance companies should consider leveraging advanced data analytics for better risk prediction, pricing, and early identification of high-risk claims. Proactive and strategic claims management is crucial, focusing on early settlements, efficient litigation strategies, and careful cost control with defense counsel. Insurers also need to advocate for legislative and legal reforms, such as tort reform and greater transparency in third-party litigation funding. Further, engaging in corporate social responsibility initiatives can also help improve public perception against corporate insureds and potentially influence jury biases.

- Cyber Insurance: Evolving Coverage for Growing Risks

Trend Overview

Cyber insurance is a volatile segment in 2025, with ransomware payments potentially reaching record highs after a $75 million attack in 2024. Businesses face heightened cyber threats, driving demand for tailored policies. Disputes over coverage scope, such as exclusions for “systemic events,” are increasing, particularly after incidents like the CrowdStrike outage, which affected millions of Windows-based computer systems around the world.

Legal Implications

- Coverage Scope: Policyholders challenge exclusions for cyber losses tied to third-party vendors or systemic failures.

- Regulatory Penalties: Insurers face disputes over coverage for fines under laws like the General Data Protection Regulation (“GDPR”) or Health Insurance Portability and Accountability Act (“HIPAA”).

- Underwriting Standards: Stricter guidelines may limit coverage availability, sparking litigation.

Insurers must craft precise cyber policies to balance coverage, profitability, and legal compliance.

- Regulatory Reforms: Balancing Affordability and Obligations

Trend Overview

Regulatory reforms are reshaping insurer obligations, with California’s Sustainable Insurance Strategy requiring insurers to cover 85% of their market share in wildfire-prone areas. States like Maryland and Virginia are increasing auto insurance minimums, which raises premiums. These reforms aim to ensure affordability but challenge insurer profitability.

Legal Implications

- Mandatory Coverage: Non-compliance with high-risk mandates leads to regulatory penalties or lawsuits.

- Rate Disputes: Policyholders contest rate hikes tied to new minimums or risk models.

- Consumer Protections: Stricter laws increase litigation risks for non-compliant insurers.

Insurers must align with ever increasing state legal mandates to avoid penalties and use risk models to justify pricing.

Conclusion

Insurance coverage law in 2025 is navigating uncharted waters, with climate risks, AI disputes, social inflation, cyber threats, and regulatory reforms redefining the industry. For insurers, these trends demand proactive strategies—refining policies, auditing AI systems, bolstering reserves, and ensuring regulatory compliance. Engaging skilled legal counsel is not just an option; it’s a necessity to secure fair outcomes and maintain resilience. As the insurance market evolves, those insurers that adapt swiftly will shape a future where coverage meets the demands of an increasingly complex world.